nebraska tax withholding calculator

Its a progressive system which means that taxpayers who earn more pay higher taxes. The state income tax rate in.

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

To change your tax withholding amount.

. TAXES 22-08 Nebraska State Income Tax Withholding. March 7 2022 Effective. W-4 Form Basic -.

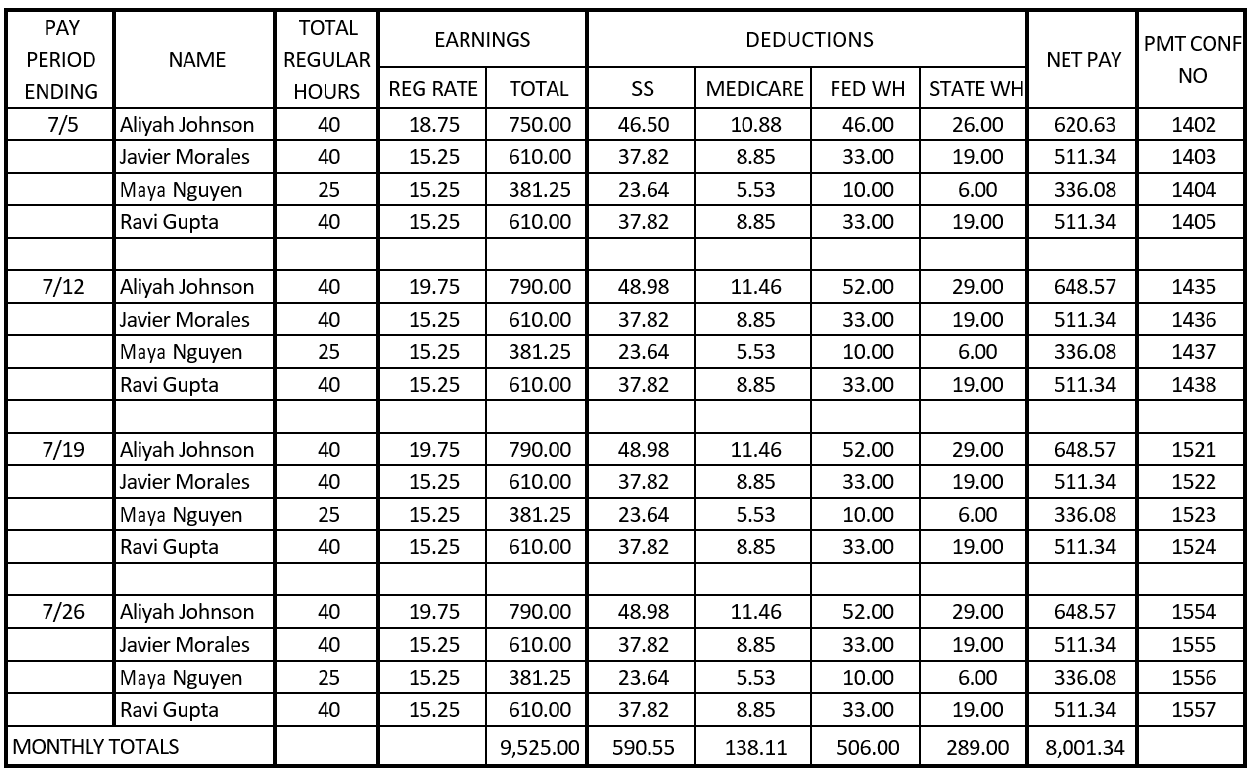

The State of Nebraska has introduced a State Form W-4N to claim marital status and exemptions for State withholding purposes effective January 1 2020. The Nebraska tax calculator is updated for the 202223 tax year. The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for.

Form W-4 Tax Withholding. Free for personal use. To determine if you are eligible to claim exempt on your W-4 see the Exemption from Withholding section of IRS Publication 515.

The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. The Federal or IRS Taxes Are Listed. The 2022 rates range from 0 to 54 on the first 9000 in wages paid to each.

As an employer in Nebraska you have to pay unemployment insurance to the state. What is the income tax rate in Nebraska. Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup.

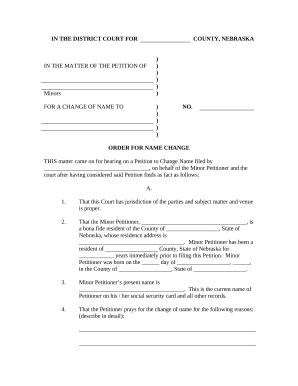

The income tax withholdings for the State of. Nebraska State Income Tax Nebraska follows federal rules for. Pay Period 04 2022.

There are four tax brackets in. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Nebraskas state income tax system is similar to the federal system.

Nebraska income tax calculator 2021. Ask your employer if they use an automated. The first deduction that all taxpayers face is fica taxes.

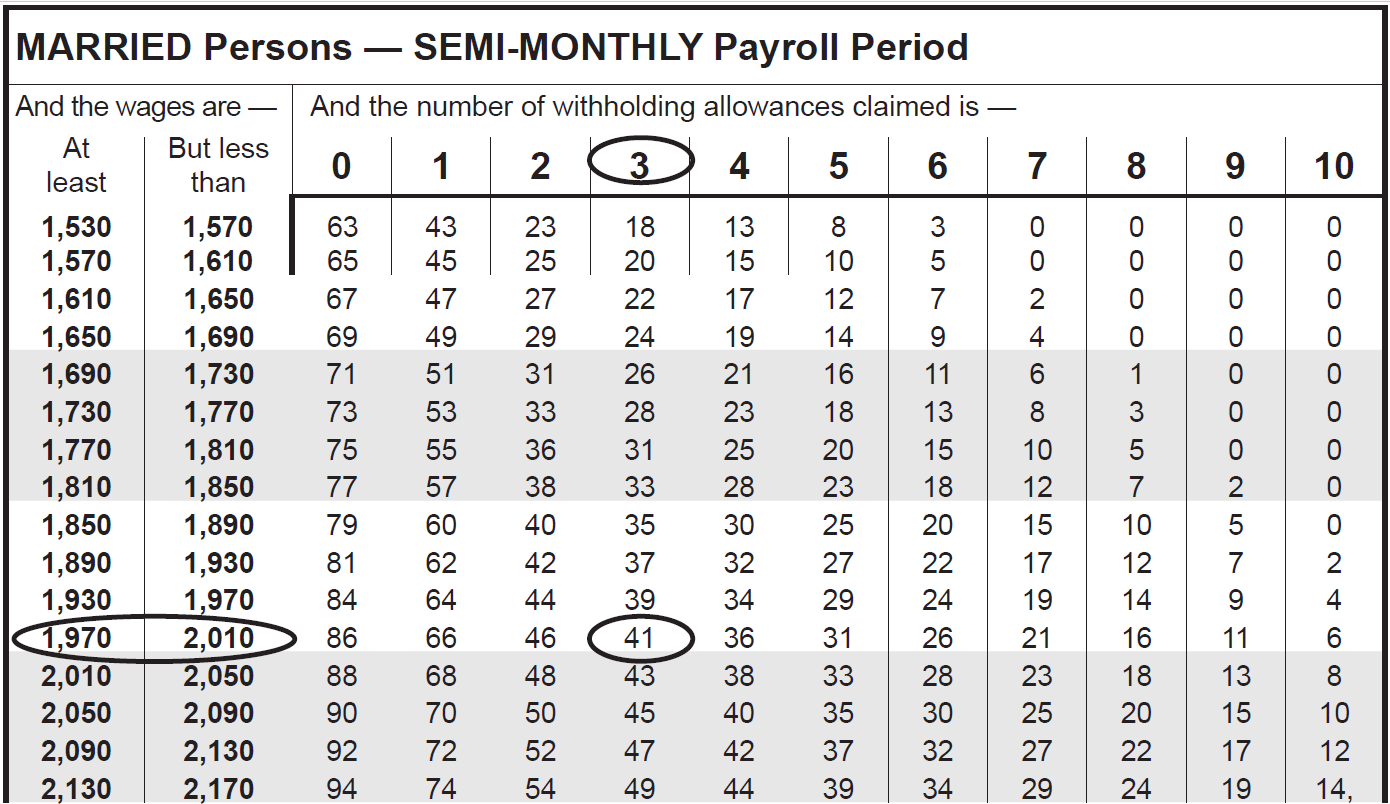

The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37. The Circular EN also includes the percentage method tables and the tax table brackets used to calculate Nebraska taxes for income tax withholding from each employee for wages paid on. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State. 00601 An employer must deduct and withhold Nebraska income tax from all wages paid to an employee who is a nonresident of Nebraska for services performed in Nebraska. Tax Calculators Tools.

Tax Withholding For Pensions And Social Security Sensible Money

Nys 50 T Nys 1 17 New York State Withholding Tax Tables And Tax Ny Fill Out Sign Online Dochub

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Nebraska Household Employment Tax And Labor Law Guide Care Com Homepay

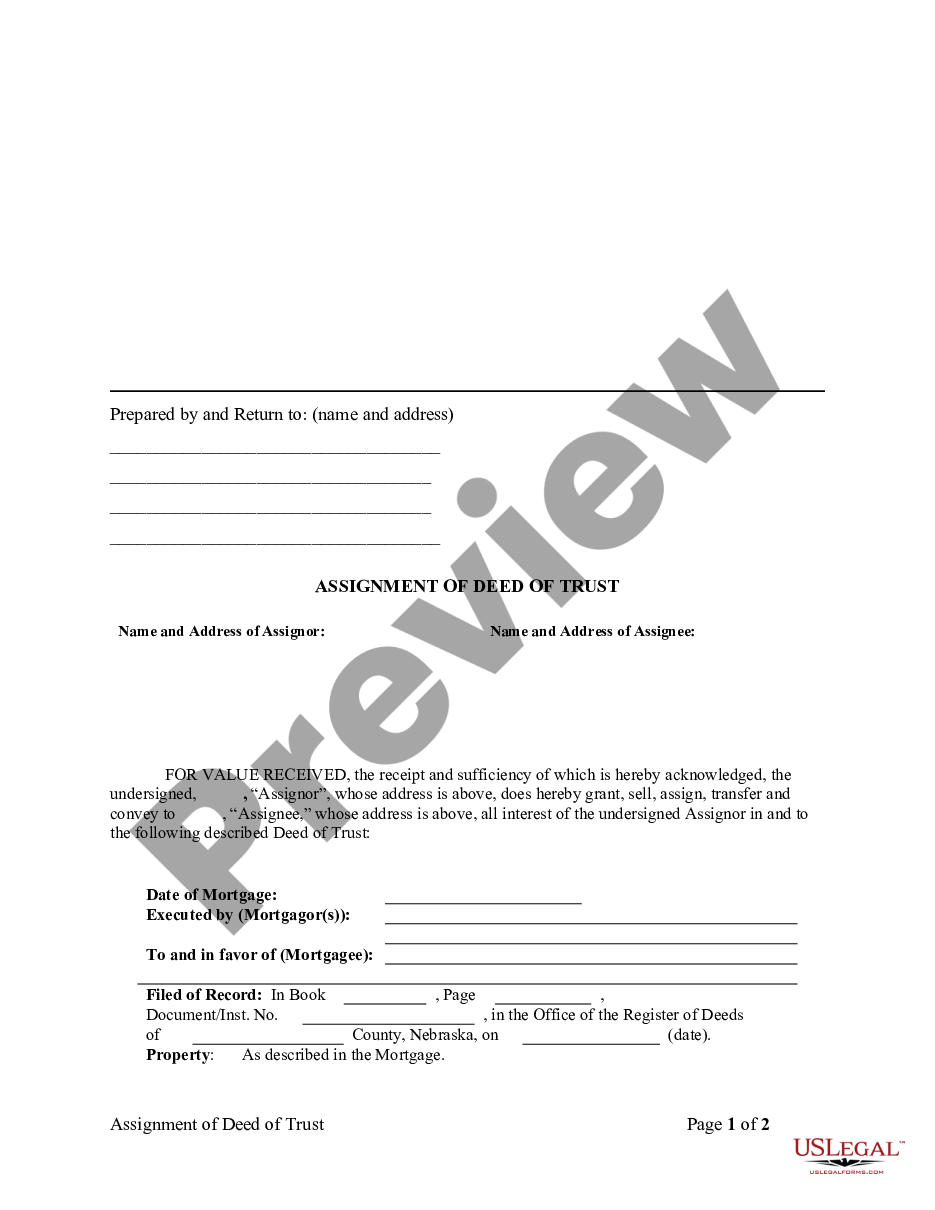

Nebraska Assignment Withholding Us Legal Forms

Flat Bonus Pay Calculator Flat Tax Rates Onpay

Lottery Calculator The Turbotax Blog

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Nebraska Hourly Paycheck Calculator Gusto

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

Annual Tax Calculator Us Icalculator 2023

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Nebraska Payroll Tools Tax Rates And Resources Paycheckcity

Irs New Form W 4 For 2021 Employee Tax Withholdings Bernieportal

Llc Tax Calculator Definitive Small Business Tax Estimator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

2019 Withholding Tables H R Block

Opportunities For Firpta Tax Withholding Reduction Exemption And Exclusion For An Entity Seller